Contents

Let’s be honest: navigating fintech risk today feels a lot like playing chess in a hurricane. You’re juggling unpredictable markets, increasingly clever fraud schemes, and a regulatory environment that changes almost quarterly. For companies using AI, the stakes are even higher.

This is why fintech AI risk management platforms have moved from being a “nice to have” to an absolute necessity.

These platforms do more than just help with compliance checklists. The right solution allows you to detect threats early, make smarter decisions, and respond quickly when things go off track. However, not all platforms are created equal.

So, what separates the best from the rest?

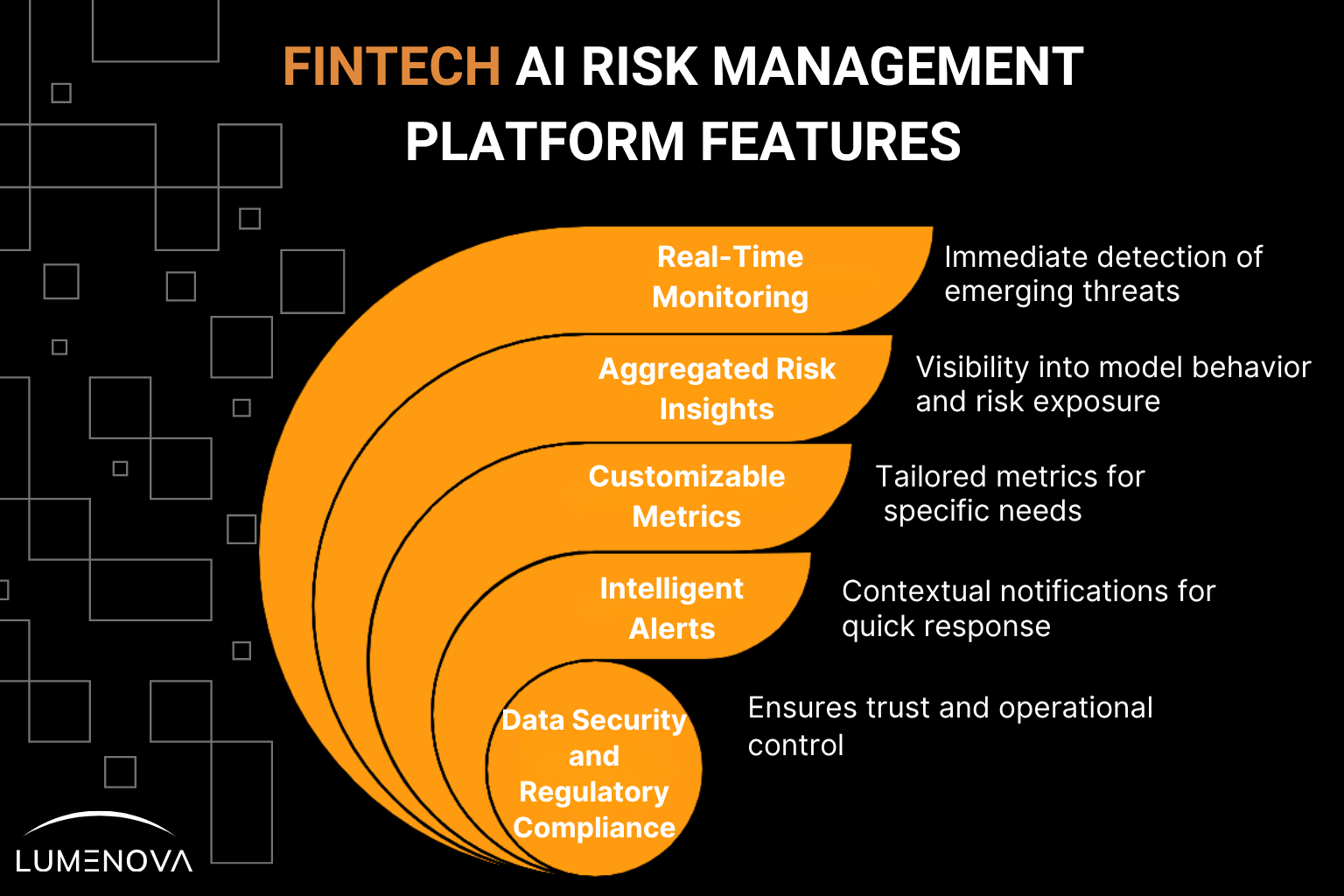

Based on current industry research and what we’re seeing from top-performing organizations, here are the five core features that define an effective AI-powered risk management platform in fintech.

In order to understand more about how explainable AI supports compliance and transparency in finance, read “Why Explainable AI in Banking and Finance Is Critical for Compliance.”

5 Key Features for Fintech AI Risk Management Platform

1. Continuous Monitoring

Why? Because waiting even a day can be costly. In risk management, timing is not just important. It’s everything.

Picture this: a new fraud pattern emerges on a Tuesday morning. If your platform doesn’t detect it until Thursday afternoon, you’ve already lost valuable time. Continuous monitoring must be at the center of your risk strategy.

The most effective platforms offer:

- Live dashboards

- Streaming analytics

- Immediate alerts on critical KPIs

Whether you’re dealing with a spike in chargebacks or a sudden change in user behavior, your team should be notified when it can still take action.

Without continuous capabilities, a platform becomes little more than a retrospective reporting tool.

To see how continuous analytics and alerts help top fintechs manage risk at speed, check out AI in Finance: The Promise and Risks of RAG & CAG vs RAG: Which One Drives Better AI Performance?.

2. Aggregated AI Risk View

Seeing isolated metrics isn’t enough. Real AI risk management means understanding how models behave in context across business units, model types, and lifecycle stages.

That’s why our RAI platform delivers a layered, unified view of your AI landscape. From high-level summaries to granular exposures, teams can easily identify where risk lives and what’s driving it.

With our platform, you can:

- Monitor risk exposure in real time across models, systems, and teams

- Drill down into individual model performance to uncover weak spots and trends

- View mitigation status and compliance posture at both strategic and operational levels

- This gives you the full picture of raw model outputs and the story behind them.

Because understanding AI risk shouldn’t require stitching together spreadsheets or toggling between tools.

3. Customizable Metrics

Your organization doesn’t operate like every other fintech, so why use off-the-shelf metrics?

Customization is essential. Your platform should let you define what matters most (whether it’s crypto volatility, transaction anomalies, onboarding fraud, or third-party exposure).

You should be able to:

- Adjust dashboards to suit business units

- Set custom thresholds based on your risk appetite

- Track metrics that align with your strategic goals

When platforms don’t offer this level of flexibility, you end up managing your business with someone else’s assumptions. That’s a risk in itself.

4. Data Security and Regulatory Compliance

Fintech lives and dies by trust. One breach, or even one non-compliant process, can cause irreversible damage to your customer relationships.

That’s why a strong AI risk management platform must come equipped with robust security and compliance features, including:

- End-to-end encryption

- Multi-factor authentication

- Fine-grained access controls

- Transparent and searchable audit trails

Equally important, the platform should support evolving standards like GDPR, PCI DSS, and SOC 2 without requiring manual workarounds.

Take, for example, a European neobank that adopted an AI-powered platform and reduced audit flags by 32 percent in just six months. These results show restored trust and better operational control.

5. Intelligent Alerts

An alert without context is just noise. What fintechs need are intelligent alerts that do more than just ring the alarm.

Your risk platform should be able to:

- Prioritize threats based on severity and likelihood

- Offer a clear explanation of why an alert was triggered

- Suggest next steps to help teams respond quickly and appropriately

Rather than flooding your team with notifications, intelligent alerts highlight what matters, why it matters, and what to do about it.

This reduces alert fatigue, shortens response times, and builds confidence in your overall risk operations.

Proof in Action: AI That’s Already Delivering Value

We have a dedicated RAI platform for identifying, assessing, and managing the risks associated with AI systems. Our tools are already in use by major enterprises to support responsible AI at scale.

Here’s how our platform delivers value today:

- Continuous Risk MonitoringThe platform actively scans AI models for key risks, including bias, data drift, robustness failures, and lack of explainability, helping teams detect issues before they affect real-world outcomes.Curious how continuous risk and drift monitoring works in practice? Check out our article: Does Your AI Monitoring System Follow These Best Practices?

- Built-In Compliance MappingOur system evaluates AI models against global regulations and standards, including:

- NIST AI Risk Management Framework (NIST RMF)

- ISO/IEC 42001 (AI management system standard)

- EU AI Act (upcoming regulatory requirement in Europe)This allows organizations to align with legal and ethical expectations from day one.

- AI Risk AdvisorOur latest feature uses AI to generate tailored risk assessments and mitigation plans, reducing the need for manual reviews and ensuring faster, more consistent oversight.

- Integration With MLOps WorkflowsLumenova fits directly into existing machine learning pipelines, giving data science and compliance teams shared visibility and a single source of truth for model performance and risk.

Organizations using our RAI platform have reported:

- Faster model reviews and approvals

- Lower internal compliance overhead

- Greater transparency across technical and business stakeholders

- Increased confidence in AI decision-making

These use cases show that operationalizing responsible AI is not only possible, but it delivers clear business benefits.

The Human Factor: AI Is a Tool, Not a Decision-Maker

No AI system is flawless. Models evolve, data shifts, and explainability is often imperfect. That’s why human oversight remains essential.

The best platforms support a human-in-the-loop model. In this setup, AI assists with detection and prioritization, but humans are still responsible for decisions and accountability.

Your team can rely on existing neural networks, but they must be able to interpret outputs, question anomalies, and act with confidence. That is only possible with platforms designed for clarity over complexity.

To learn more about balancing AI efficiency with human oversight and preventing automation bias, read Overreliance on AI: Addressing Automation Bias Today.

Looking Ahead: Risk Management Will Shape Fintech’s Future

AI is quickly becoming central to how fintechs operate, playing a key role in risk management and across the board. Its impact on risk governance will be particularly decisive.

To remain competitive and compliant, an AI risk platform must be equipped to support:

- Continuous AI monitoring & risk signals

- Transparent and actionable analytics

- Built-in compliance support

- Customization by use case

- Alerts that come with context

If your current system doesn’t provide these capabilities, it’s time to rethink your approach.

Ready to explore what’s next? Book your demo for a personalized walkthrough or a proof-of-value engagement tailored to your risk goals.

Final Thoughts

Managing risk in fintech isn’t about predicting the future with perfection. It’s about preparing your team to detect issues early, understand what’s happening, and respond clearly and confidently.

AI can provide powerful insights, but what your organization does with those insights is what defines long-term success.

Reflective Questions

- How confident are you in your platform’s ability to detect emerging risks in real time?

- Are you getting meaningful insights (or just more dashboards to interpret)?

- What would a smarter, more secure AI risk platform free up for your team to focus on?

Frequently Asked Questions

A fintech AI risk management platform uses artificial intelligence to identify, assess, and mitigate risks in real time. It helps fintech companies prevent fraud, meet regulatory requirements, and improve decision-making.

Continuous monitoring enables instant detection of threats and anomalies, allowing organizations to respond proactively. This minimizes financial losses and ensures better compliance with evolving regulations.

AI streamlines compliance by automating data tracking, generating audit-ready reports, and ensuring adherence to standards like GDPR, PCI DSS, and local financial regulations.

These systems use AI to evaluate the severity of detected risks and alert teams in real time. They prioritize alerts based on impact and likelihood, helping teams focus on the most critical issues.

Absolutely. While AI enhances speed and accuracy, human judgment is essential for interpreting complex scenarios, ensuring ethical practices, and making final decisions.