September 2, 2025

How AI Consulting Companies Are Transforming the Insurance Industry

Contents

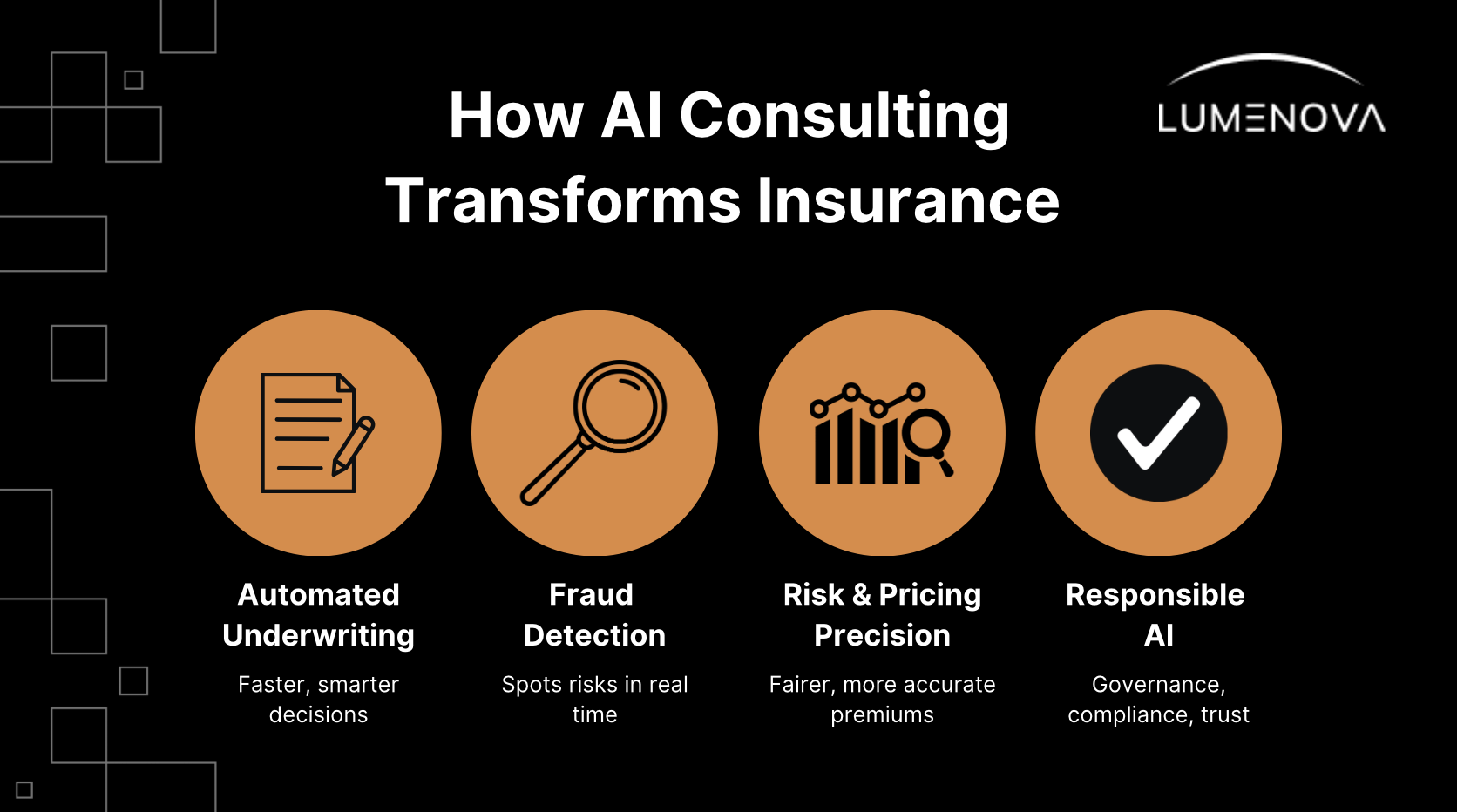

Insurance companies face growing pressure to modernize. Tight profit margins, changing customer expectations, and increasingly complex risks mean they need smarter, faster solutions. Which is why AI consulting firms are stepping in to help insurers improve efficiency and stay competitive. They support automating underwriting, catching fraud early, and making better risk and pricing decisions, all while building AI systems insurers can trust.

Automating Underwriting with AI

Underwriting is the process insurers use to decide whether to offer coverage and at what price. Traditionally, it involves manual review of paperwork and cautious assumptions to avoid risk. AI consultants step in to help insurers use computer programs that learn from data, like customer profiles and past claims, to speed up this process and make smarter, more consistent decisions. This saves time and money, reducing human error. We have explained more about the AI’s benefits and risks in insurance in our AI in the Insurance Industry: What to Know About Managing AI Risk article.

Detecting and Preventing Fraud Proactively

Insurance fraud costs the U.S. economy approximately $308.6 billion annually, leading to higher premiums for policyholders, who pay around $900 more per year on average to cover these losses. AI firms install systems that watch for unusual claim patterns and alert insurers instantly. These tools learn to recognize new types of fraud as criminals change tactics, making fraud detection faster and more reliable without needing constant manual checks. By adopting AI consulting services, insurers can reduce operational costs by up to 20% annually through automation and improved efficiency, while speeding up claims processing by as much as 50% (BCG, April 2025), benefits that directly impact their bottom line and customer satisfaction.

Enhancing Risk Assessment and Pricing Precision

Accurate risk pricing is the lifeblood of insurance. AI consultants help insurers apply predictive analytics, combining traditional actuarial data with real-time inputs, from IoT devices to economic indicators, to create dynamic pricing models. This improves profitability and ensures fairer premiums. Lumenova’s insights in The AI Revolution in Insurance: Risks & Solutions provide a valuable overview of how these models are reshaping the industry.

Why Responsible AI Matters More Than Ever

Innovation must go hand in hand with responsibility. AI models can inadvertently reproduce biases, leading to unfair pricing or claim denials. Consulting partners who guide insurers through this process prioritize fairness, transparency, and compliance. Carriers also need to stay ahead of new regulations like the EU AI Act and emerging state legislation.

Understanding how to balance AI opportunity with governance is essential. Regulatory Insights for AI in Insurance explains how providers can build internal AI governance frameworks that align with both industry-wide and sector-specific rules.

Strengthening Trust with AI Auditability

Besides building models, AI consultants help implement auditing frameworks that ensure ongoing fairness, compliance, and resilience. Scenario-based auditing, such as testing AI systems under different conditions, can reveal biases or vulnerabilities before they impact operations. Lumenova’s article on AI Audit Tools and Scenarios for Insurance offers practical ways to enhance operational trust and readiness.

AI Consultants Guide Toward Long-Term Strategy

AI consulting firms are not just technical vendors. They are strategic enablers. They align AI projects with business objectives, train internal teams, and design scalable governance systems. If your team is wondering when and how to bring in outside help, Do You Need an AI Consultant? outlines the key signs that a strategic advisor could unlock value.

Lumenova’s AI solutions for insurance support this approach with governance frameworks, model risk monitoring, and compliance visibility that help insurers deploy ethical, transparent AI.

Looking Ahead: The Future of AI in Insurance

Emerging AI technologies promise even greater transformation. Advances in natural language processing will improve customer service chatbots and claims handling. Generative AI could automate complex report writing and policy creation. Additionally, AI-driven compliance tools will help insurers keep pace with evolving regulations more easily.

Insurance companies that invest in responsible AI today, guided by experienced consultants, will be best positioned to thrive in tomorrow’s market. If you’re ready to explore how AI can accelerate your business while keeping risks under control, book a consultation with our team or schedule a demo to see how we can help.